Homeowners Insurance in and around Asheville

Looking for homeowners insurance in Asheville?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

After a long day, there’s nothing better than coming home. Home is where you recharge, catch your breath and chill out. It’s where you build a life with the ones you love.

Looking for homeowners insurance in Asheville?

Give your home an extra layer of protection with State Farm home insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

Your home is the cornerstone for the life you cherish. That’s why you need State Farm homeowners insurance, just in case trouble finds you. Agent Bill Russell can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Bill Russell, with a no-nonsense experience to get reliable coverage for your homeowner insurance needs. Customizable care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

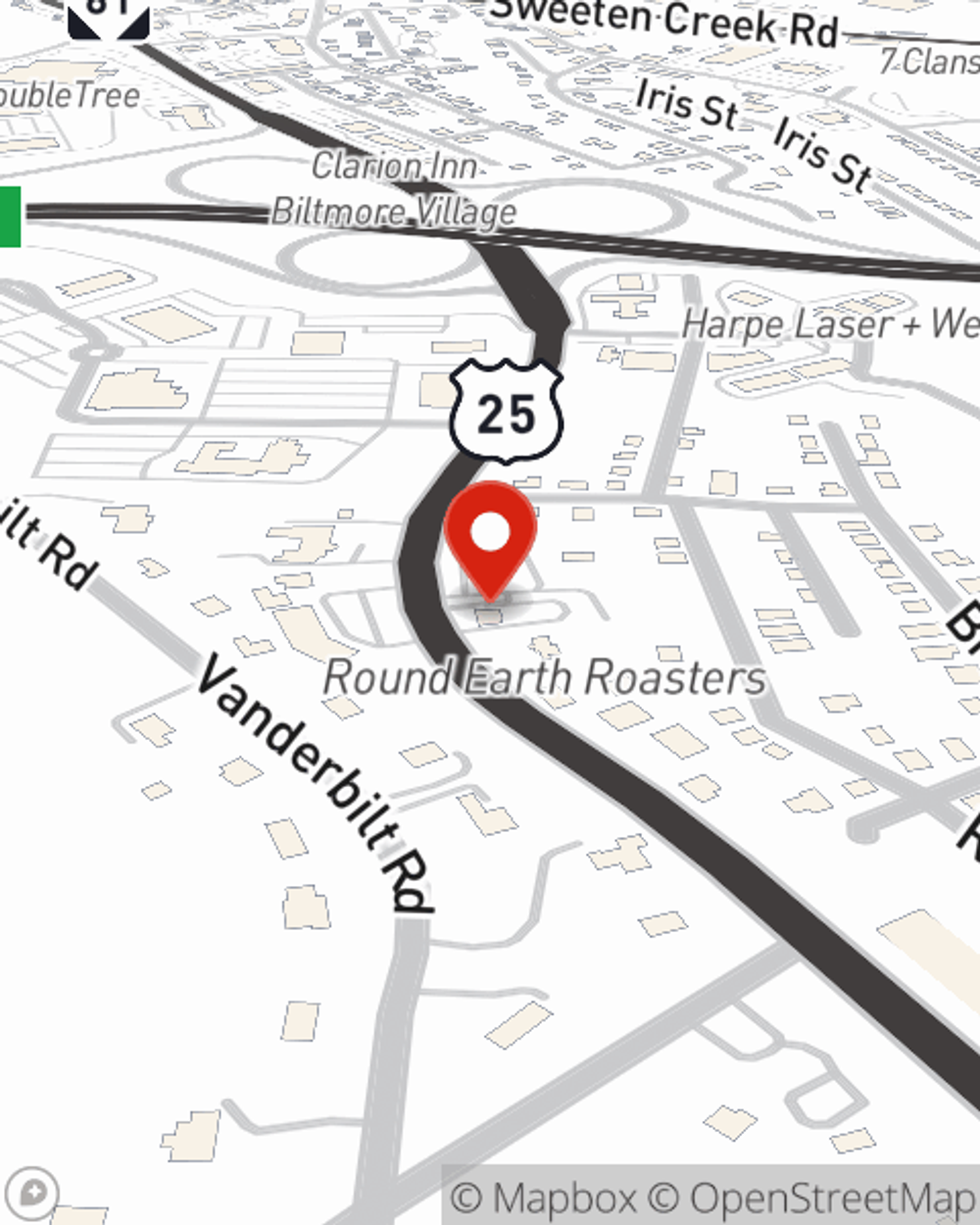

When your Asheville, NC, residence is insured by State Farm, even if the unexpected happens, your home may be covered! Call or go online today and see how State Farm agent Bill Russell can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Bill at (828) 274-7388 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Bill Russell

State Farm® Insurance AgentSimple Insights®

What to include in an emergency kit

What to include in an emergency kit

Having emergency kit supplies prepared ahead of time may give you the resources you and your family need to stay safe.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.