Renters Insurance in and around Asheville

Your renters insurance search is over, Asheville

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or property, renters insurance can be the most sensible step to protect your personal property, including your children's toys, bed, running shoes, microwave, and more.

Your renters insurance search is over, Asheville

Coverage for what's yours, in your rented home

There's No Place Like Home

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Bill Russell can help you identify the right coverage for when the unexpected, like an accident or a fire, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Asheville renters, are you ready to see how helpful renters insurance can be? Contact State Farm Agent Bill Russell today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Bill at (828) 274-7388 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

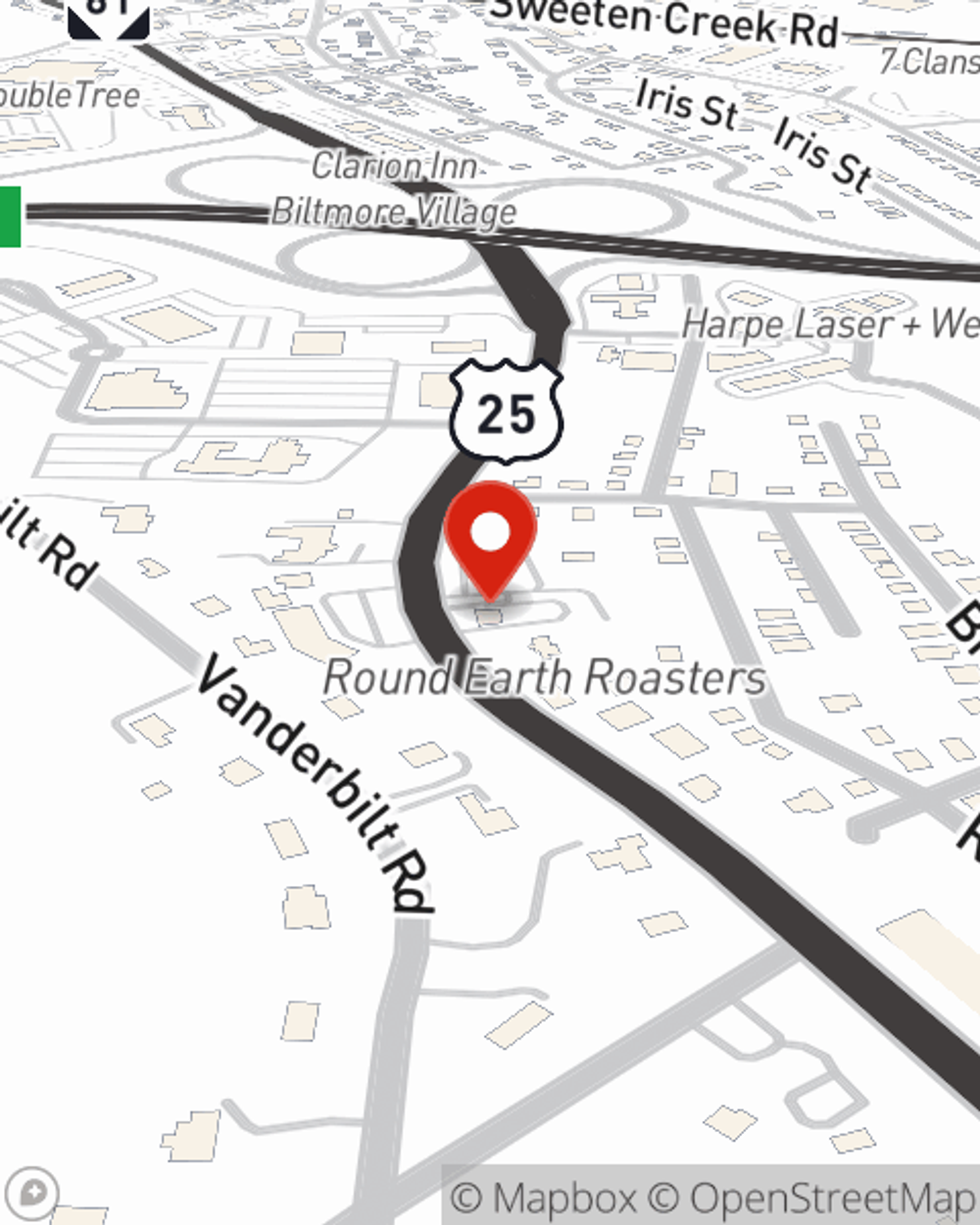

Bill Russell

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.